SRINAGAR SEPTEMBER 25: J&K government has disbursed Rs 960.39 Cr among 25449 beneficiaries under self-employment schemes in Srinagar.

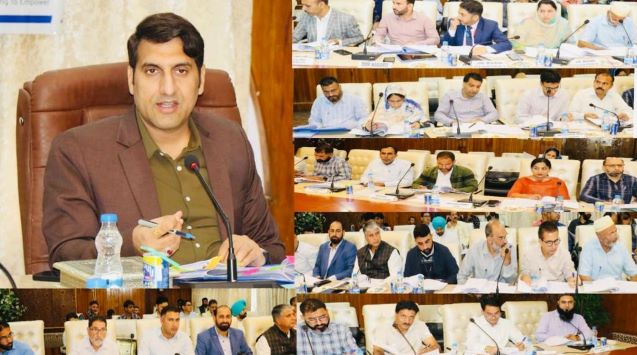

Deputy Commissioner (DC) Srinagar, Mohammed Aijaz Asad Monday chaired a meeting of the District Level Bankers Review Committee/District Consultative Committee (DLRC/DCC) to review the performance of the banks and other financial institutions under various government initiatives and sponsored schemes for the quarter ending June 2023.

The DC was informed that total deposits of the District Srinagar stood at Rs 34448.37 crore and Advance at Rs 24009.31 crore, constituting a 70 percent CD Ratio in the first quarter of the current financial year that ended in June 2023.

The DC was apprised that an amount of Rs 960.39 Crore has been disbursed among 25449 beneficiaries in Srinagar under different schemes thereby generating self-employment opportunities for over 62000 unemployed youth of the District during financial year 2022-23.

Besides, the Banks operating in Srinagar have provided a total credit of Rs.1691.31 Crore in favour of 54488 beneficiaries under both Priority as well as Non-Priority Sector during for financial year 2023-24.

The DC was further apprised that under Prime Minister Mudra Yojna (PMMY) Scheme Banks operating in Srinagar have disbursed Rs 277.83 Crore among 8189 beneficiaries of the District during Financial year 2023-24.

Similarly, under the Pradhan Mantri Employment Generation Program (PMEGP), a total of 1201 cases have been sanctioned and an amount of Rs 67.91 Crore has also been sanctioned.

About the implementation of Pradhan Mantri SVANIDHI schemes, the DC was informed that Rs 9.61 crore has been disbursed among 6993 Street Vendors of the District.

While reviewing the progress achieved in enrolment under social security schemes including Pradhan Mantri Jeevan Jyoti Bima Yojana(PMJJBY)/Pradhan Mantri Suraksha Bima Yojana(PMSBY) and Atal Pension Yojana (APY), the DC was informed that under as many as 171243 registrations have been made till August 2023 including 125089 under PMSBY, 37876 under PMJJBY and 8278 under APY scheme.

It was also given out that during the recently held Jansuraksha campaign after the Ministry of Finance, Department of Financial Services, Government of India launched a 3-month campaign across the country to saturate all the eligible beneficiaries under Jansuraksha, a total number of 33641 enrolments were registered under these schemes.

Under Mission Youth schemes, for providing self-employment, the DC was informed that under the MUMKIN scheme, a total of 245 cases have been sanctioned so far involving an amount of Rs 17.36 Crore Similarly, under the TEJASWINI scheme 111 cases have been sanctioned in the District with an amount of Rs 5.27 Crore in favor of the beneficiaries.

Likewise, the meeting was informed that under the Swarozgar Utsav campaign launched as a step towards saturation of self-employment of the youth as many as 1121 beneficiaries have been sanctioned credit amounting to the tune of Rs 135.32 crore.

During the meeting, DC also took a detailed appraisal of the activities conducted in Digital Week and Brashtrachar Mukt Week held from August 31 to September 09, 2023. He was informed that over 400 awareness programs on Digital Literacy were held in the District and 3527 beneficiaries availed benefits of Banking sector schemes through online mode.

The DC was informed that about 75% of digital coverage has been registered in Srinagar as of the quarter that ended June 2023 with at least one of the digital modes adopted by the Bank customers in the District.

During the meeting, the performance of Banks under Kissan Credit Card (KCC), RSETI, NULM, PMFME, FLCCs, and CFLs was also reviewed.

Speaking on the occasion, the DC stressed all the line Departments and Banks operating in the District to further improve the credit facilities and CD ratio. He also called for educating people about financial literacy and the Digital Payment Ecosystem by bridging the digital gap to ensure cent percent coverage.

He called upon Officers of all line Departments and Bankers to work in a coordinated manner with added vigor and zeal to achieve the set targets within the set timeline.

While appreciating the LDM, his team, and other stakeholders for their work and for improving their performance, the DC asked them to continue their efforts with a customer-friendly approach to ensure better facilities and services to the Customers up to their satisfaction.

The DC emphasized on improvement of other schemes and flagship programs of the Government and focused attention on targets set for the financial year 2023-24.

The meeting was among others attended by Chief Planning Officer, Mohammad Yaseen Lone, GM DIC, Hamida Akhtar, Lead District Manager, Abdul Majid, all District Officers, Cluster Heads of J&K Bank, representatives of Banks and financial institutions operating in Srinagar.__thekashmirmonitor.net